The following asset allocation portfolio templates are derived from renowned lazy portfolios. Depending on the available asset classes encompassed by the investment options in your plan, you select a template portfolio and then meticulously adjust risk asset allocation based on the risk profile determined for the account.

Major core assets

Generally, investment options in a 401(k) plan are categorized into distinct asset classes, each offering unique characteristics and risk-return profiles:

US Stocks: US stocks represent ownership shares (equities) in companies listed on American stock exchanges. The US economy is more than one third of the world economy. They are known for their potential for capital appreciation, dividends, and playing a crucial role in a diversified portfolio.

Developed Country (Foreign) Stocks: Comprising stocks from established economies outside the United States including Europe and Japan, developed country stocks add international diversification. These investments can provide exposure to different economic cycles and global market trends, contributing to a well-rounded investment strategy.

Emerging Market Stocks: Emerging market stocks involve equities from economies experiencing rapid growth and development. While offering higher growth potential in certain periods, they also come with increased volatility, making them a distinctive asset class suitable for investors seeking more risk and return.

Real Estate Investment Trusts (REITs): REITs are investment vehicles that own, operate, or finance income-generating real estate across various sectors. Investing in REITs can provide diversification and income through dividends, making them an attractive option for those looking for exposure to the real estate market. REITs are an important diversifier.

Commodities: Commodities include physical goods such as gold, silver, oil, and agricultural products. Investing in commodities can act as a hedge against inflation and provide diversification, as their value is often influenced by factors beyond traditional financial markets. However, they often exhibit high volatility. Most 401(k) plans do offer investment options for commodities.

Bonds: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. They are considered more conservative investments, offering fixed interest payments and returning the principal at maturity. Bonds play a crucial role in balancing risk in a diversified portfolio.

Cash: Cash, within the context of a 401(k) plan, typically refers to money market funds or stable value funds. While providing stability and liquidity, cash investments offer lower returns compared to riskier asset classes, making them suitable for capital preservation and short-term needs.

Core asset portfolios

The following table shows asset allocation templates based on the core assets selected.

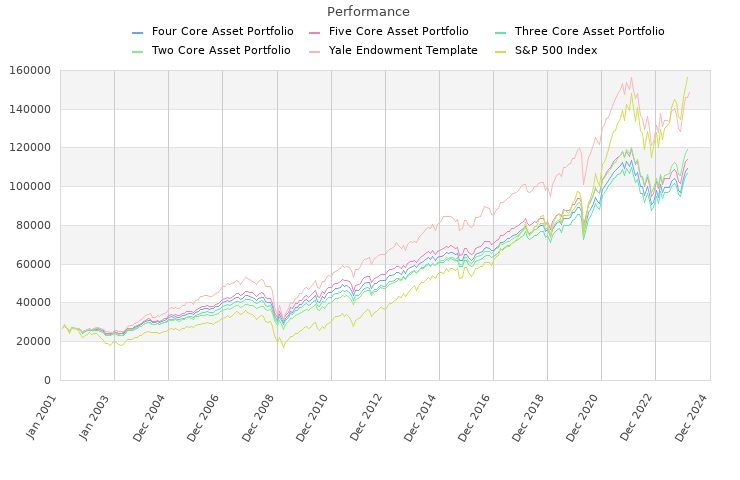

| Name | YTD Return | 1Yr AR | 3Yr AR | 5Yr AR | 10Yr Ar | 15Yr Ar | 20Yr Ar |

|---|---|---|---|---|---|---|---|

| Four Core Asset Portfolio | 2.77% | 7.49% | 7.66% | 8.36% | 6.31% | 7.37% | 6.84% |

| Five Core Asset Portfolio | 2.58% | 7.46% | 7.54% | 8.22% | 6.24% | 7.26% | 6.92% |

| Three Core Asset Portfolio | 2.75% | 7.72% | 8.47% | 8.80% | 6.70% | 7.66% | 6.98% |

| Two Core Asset Portfolio | 1.01% | 8.53% | 9.28% | 9.39% | 7.84% | 8.86% | 7.69% |

| Yale Endowment Template | 3.11% | 7.71% | 7.01% | 8.36% | 6.72% | 8.21% | 7.60% |

| S&P 500 Index | 1.76% | 13.83% | 15.73% | 17.51% | 12.76% | 13.69% | 10.51% |

| Ticker/Portfolio | Last 1 Week | 1 Yr | 3 Yr | 5 Yr | 10 Yr | 15 Yr | 20 Yr | Inception | YTD | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Annualized Return (%) | Four Core Asset Portfolio | 2.32 | 7.49 | 7.66 | 8.36 | 6.31 | 7.37 | 6.84 | 6.98 | 2.77 | 9.54 | 14.97 | -16.99 | 12.91 | 13.52 | 19.68 | -4.72 | 14.15 | 7.06 | -0.46 | 7.63 | 13.58 | 11.50 | 1.37 | 12.72 | 21.97 | -21.79 | 6.60 | 14.66 | 6.43 | 11.39 | 22.01 | -6.93 | -3.53 | -1.09 | 12.59 | 13.06 | 15.13 | 8.11 |

| Five Core Asset Portfolio | 2.38 | 7.46 | 7.54 | 8.22 | 6.24 | 7.26 | 6.92 | 7.07 | 2.58 | 9.78 | 14.64 | -17.08 | 12.47 | 13.73 | 19.62 | -4.75 | 14.35 | 7.41 | -0.97 | 7.87 | 12.50 | 11.51 | 1.11 | 13.09 | 23.34 | -22.19 | 7.80 | 15.08 | 7.43 | 11.86 | 23.07 | -6.52 | -2.67 | -1.81 | 13.70 | 11.45 | 14.34 | 8.05 | |

| Three Core As…Portfolio | 2.56 | 7.72 | 8.47 | 8.80 | 6.70 | 7.66 | 6.98 | 7.02 | 2.75 | 10.70 | 15.78 | -16.57 | 12.12 | 15.05 | 19.74 | -4.68 | 15.12 | 7.28 | -0.57 | 6.67 | 15.31 | 11.39 | 0.93 | 11.74 | 21.20 | -21.84 | 7.96 | 13.55 | 6.15 | 10.42 | 21.73 | -8.46 | -4.82 | -2.91 | 14.68 | 16.00 | 16.31 | 7.16 | |

| Two Core Asset Portfolio | 3.14 | 8.53 | 9.28 | 9.39 | 7.84 | 8.86 | 7.69 | 8.20 | 1.01 | 13.70 | 17.54 | -16.85 | 13.96 | 16.46 | 21.70 | -2.98 | 13.74 | 8.83 | 0.35 | 9.73 | 17.90 | 11.26 | 4.22 | 13.03 | 19.61 | -21.20 | 6.27 | 11.14 | 4.56 | 8.97 | 19.78 | -9.65 | -2.99 | -1.72 | 13.49 | 17.53 | 22.03 | 13.50 | |

| Yale Endowment Template | 2.17 | 7.71 | 7.01 | 8.36 | 6.72 | 8.21 | 7.60 | 7.66 | 3.11 | 7.30 | 15.32 | -18.89 | 17.42 | 13.13 | 24.27 | -5.49 | 14.66 | 8.48 | -1.41 | 13.85 | 9.17 | 13.57 | 5.24 | 15.61 | 23.65 | -24.82 | 5.76 | 17.46 | 9.51 | 16.63 | 27.23 | -3.84 | -1.69 | ||||||

| S&P 500 Index | 5.33 | 13.83 | 15.73 | 17.51 | 12.76 | 13.69 | 10.51 | 11.05 | 1.76 | 24.84 | 26.12 | -18.24 | 28.53 | 18.74 | 31.33 | -4.55 | 21.66 | 11.83 | 1.23 | 13.52 | 32.17 | 15.82 | 1.96 | 14.91 | 26.52 | -37.02 | 5.39 | 15.64 | 4.77 | 10.74 | 28.50 | -22.17 | -12.03 | -9.05 | 21.08 | 28.62 | 33.18 | 22.87 | |

| Sharpe Ratio | Four Core Asset Portfolio | NA | 0.11 | 0.30 | 0.53 | 0.44 | NA | NA | 0.52 | 0.12 | 0.37 | 1.22 | -1.24 | 1.61 | 0.70 | 2.98 | -0.70 | 3.51 | 0.87 | -0.06 | 1.24 | 1.92 | 1.55 | 0.10 | 1.10 | 1.46 | -1.09 | 0.37 | 1.64 | 0.69 | 1.53 | 2.86 | -0.75 | -0.60 | -0.48 | 1.16 | 1.05 | 1.45 | 1.01 |

| Five Core Asset Portfolio | NA | 0.11 | 0.29 | 0.52 | 0.44 | NA | NA | 0.53 | 0.11 | 0.41 | 1.19 | -1.26 | 1.55 | 0.72 | 2.96 | -0.69 | 3.56 | 0.92 | -0.12 | 1.28 | 1.77 | 1.56 | 0.08 | 1.14 | 1.55 | -1.10 | 0.48 | 1.68 | 0.84 | 1.60 | 3.07 | -0.74 | -0.51 | -0.54 | 1.28 | 0.86 | 1.33 | 0.99 | |

| Three Core As…Portfolio | NA | 0.13 | 0.37 | 0.57 | 0.47 | NA | NA | 0.52 | 0.11 | 0.51 | 1.34 | -1.20 | 1.47 | 0.79 | 2.84 | -0.66 | 3.70 | 0.89 | -0.07 | 1.04 | 2.18 | 1.51 | 0.07 | 1.06 | 1.53 | -1.13 | 0.52 | 1.48 | 0.65 | 1.38 | 2.65 | -0.83 | -0.67 | -0.59 | 1.30 | 1.28 | 1.49 | 0.79 | |

| Two Core Asset Portfolio | NA | 0.19 | 0.41 | 0.59 | 0.55 | NA | NA | 0.59 | -0.01 | 0.85 | 1.47 | -1.14 | 1.68 | 0.81 | 2.88 | -0.44 | 3.30 | 1.11 | 0.04 | 1.47 | 2.61 | 1.53 | 0.31 | 1.23 | 1.19 | -0.96 | 0.36 | 1.18 | 0.37 | 1.14 | 2.01 | -0.77 | -0.41 | -0.41 | 0.93 | 1.25 | 1.82 | 1.25 | |

| Yale Endowment Template | NA | 0.12 | 0.21 | 0.48 | 0.43 | NA | NA | 0.50 | 0.13 | 0.08 | 1.04 | -1.25 | 1.94 | 0.64 | 3.26 | -0.71 | 2.56 | 0.89 | -0.15 | 2.14 | 1.04 | 1.67 | 0.35 | 1.14 | 0.96 | -0.93 | 0.23 | 1.69 | 0.97 | 1.97 | 3.28 | -0.48 | -0.40 | ||||||

| S&P 500 Index | NA | 0.38 | 0.63 | 0.83 | 0.60 | NA | NA | 0.45 | 0.07 | 1.44 | 1.69 | -0.81 | 2.17 | 0.53 | 2.40 | -0.34 | 3.16 | 0.89 | 0.08 | 1.19 | 2.90 | 1.25 | 0.08 | 0.82 | 0.97 | -0.92 | 0.15 | 1.24 | 0.25 | 0.88 | 1.63 | -0.90 | -0.68 | -0.59 | 0.98 | 1.24 | 1.62 | 1.63 | |

| Standard Deviation(%) | Four Core Asset Portfolio | NA | 10.54 | 10.94 | 10.75 | 10.44 | NA | NA | 10.28 | 13.99 | 7.92 | 8.80 | 14.78 | 8.00 | 18.86 | 6.13 | 8.69 | 3.85 | 7.87 | 8.20 | 6.15 | 7.06 | 7.37 | 13.22 | 11.45 | 14.96 | 20.88 | 9.74 | 6.93 | 6.19 | 6.83 | 7.46 | 10.70 | 9.72 | 10.74 | 8.08 | 9.31 | 8.01 | 5.86 |

| Five Core Asset Portfolio | NA | 10.46 | 10.81 | 10.67 | 10.38 | NA | NA | 10.28 | 13.90 | 7.84 | 8.72 | 14.60 | 8.06 | 18.69 | 6.15 | 8.75 | 3.86 | 7.83 | 8.23 | 6.15 | 7.05 | 7.35 | 13.16 | 11.43 | 15.02 | 20.99 | 10.02 | 7.04 | 6.26 | 6.84 | 7.29 | 10.33 | 9.76 | 10.89 | 8.18 | 9.46 | 8.15 | 5.89 | |

| Three Core As…Portfolio | NA | 10.90 | 11.04 | 10.87 | 10.54 | NA | NA | 10.35 | 14.49 | 8.03 | 8.64 | 14.97 | 8.24 | 18.66 | 6.46 | 9.11 | 3.92 | 7.94 | 8.31 | 6.40 | 7.01 | 7.53 | 13.01 | 11.02 | 13.77 | 20.07 | 9.52 | 6.95 | 6.08 | 6.87 | 7.93 | 11.54 | 10.60 | 11.83 | 8.81 | 9.88 | 8.58 | 6.27 | |

| Two Core Asset Portfolio | NA | 11.89 | 11.81 | 11.47 | 11.18 | NA | NA | 10.92 | 16.05 | 8.35 | 9.02 | 16.04 | 8.29 | 19.99 | 7.04 | 9.76 | 3.97 | 7.78 | 8.70 | 6.62 | 6.85 | 7.32 | 13.42 | 10.48 | 16.44 | 23.10 | 9.22 | 6.65 | 6.50 | 7.02 | 9.51 | 14.05 | 12.90 | 14.33 | 11.02 | 11.41 | 10.17 | 7.98 | |

| Yale Endowment Template | NA | 11.72 | 12.48 | 11.97 | 11.68 | NA | NA | 12.76 | 15.42 | 9.12 | 10.68 | 16.28 | 8.98 | 20.30 | 7.02 | 9.54 | 5.48 | 9.27 | 9.68 | 6.48 | 8.82 | 8.12 | 14.78 | 13.56 | 24.55 | 27.72 | 12.13 | 8.41 | 7.60 | 7.94 | 8.10 | 10.36 | 9.98 | ||||||

| S&P 500 Index | NA | 19.56 | 18.10 | 17.84 | 18.46 | NA | NA | 18.11 | 27.09 | 12.67 | 13.09 | 24.19 | 13.11 | 34.69 | 12.48 | 17.11 | 6.68 | 13.11 | 15.51 | 11.39 | 11.07 | 12.74 | 23.36 | 18.07 | 27.22 | 40.99 | 16.02 | 10.04 | 10.29 | 11.10 | 17.04 | 25.96 | 21.55 | 22.20 | 18.17 | 20.48 | 18.21 | 11.77 | |

| Draw Down(%) | Four Core Asset Portfolio | NA | 10.91 | 13.45 | 22.62 | 22.62 | NA | NA | 34.13 | 10.21 | 4.43 | 8.90 | 22.49 | 3.64 | 22.28 | 2.77 | 10.80 | 1.44 | 5.74 | 7.94 | 4.47 | 6.29 | 5.84 | 11.59 | 8.34 | 14.31 | 31.61 | 5.92 | 6.04 | 4.07 | 6.93 | 5.80 | 15.11 | 14.62 | 7.65 | 5.57 | 11.93 | 5.75 | 4.16 |

| Five Core Asset Portfolio | NA | 11.04 | 13.39 | 22.57 | 22.57 | NA | NA | 34.25 | 10.24 | 4.34 | 8.86 | 22.41 | 3.81 | 22.14 | 2.84 | 10.94 | 1.50 | 5.66 | 8.47 | 4.49 | 6.51 | 5.84 | 11.76 | 8.20 | 14.05 | 32.02 | 6.06 | 6.47 | 4.33 | 7.38 | 5.65 | 15.07 | 14.62 | 8.12 | 5.75 | 12.03 | 6.06 | 4.18 | |

| Three Core As…Portfolio | NA | 11.10 | 12.99 | 22.45 | 22.45 | NA | NA | 33.37 | 10.62 | 4.28 | 8.61 | 21.99 | 3.70 | 21.92 | 3.04 | 11.45 | 1.24 | 5.78 | 8.03 | 4.73 | 5.71 | 6.15 | 11.59 | 8.72 | 13.83 | 30.66 | 5.79 | 6.39 | 4.27 | 6.29 | 6.35 | 16.36 | 16.36 | 8.82 | 5.90 | 11.94 | 6.00 | 4.55 | |

| Two Core Asset Portfolio | NA | 12.48 | 13.20 | 21.52 | 22.27 | NA | NA | 35.12 | 11.89 | 4.54 | 8.31 | 21.30 | 3.68 | 22.27 | 3.24 | 11.80 | 1.41 | 5.97 | 7.32 | 4.11 | 4.76 | 5.27 | 10.95 | 8.87 | 17.61 | 31.12 | 5.49 | 4.85 | 4.27 | 5.60 | 7.27 | 18.53 | 16.41 | 10.23 | 7.28 | 12.38 | 6.36 | 5.53 | |

| Yale Endowment Template | NA | 12.30 | 15.43 | 25.29 | 25.29 | NA | NA | 43.69 | 10.83 | 5.20 | 10.97 | 25.28 | 4.68 | 23.52 | 2.87 | 11.06 | 2.52 | 6.12 | 10.16 | 4.54 | 9.46 | 5.62 | 11.69 | 8.83 | 22.40 | 39.02 | 7.41 | 6.86 | 4.79 | 9.29 | 5.98 | 14.04 | 14.10 | ||||||

| S&P 500 Index | NA | 18.76 | 18.76 | 24.59 | 33.83 | NA | NA | 55.25 | 18.76 | 8.45 | 9.97 | 24.59 | 5.14 | 33.83 | 6.63 | 19.40 | 2.60 | 10.29 | 12.05 | 7.30 | 5.59 | 9.60 | 18.71 | 15.66 | 27.17 | 47.73 | 9.88 | 7.47 | 7.01 | 7.47 | 13.79 | 33.02 | 29.18 | 16.55 | 11.81 | 19.20 | 10.79 | 7.45 | |

| Yield(%) | Four Core Asset Portfolio | NA | 2.04 | 2.20 | 2.16 | 2.33 | NA | NA | 0.00 | 0.00 | 2.03 | 2.74 | 1.89 | 2.05 | 2.18 | 2.81 | 2.33 | 2.53 | 2.57 | 2.26 | 2.61 | 2.48 | 2.88 | 2.79 | 2.75 | 3.57 | 3.10 | 3.47 | 3.53 | 2.94 | 2.77 | 3.51 | 3.34 | 3.64 | 4.14 | 3.69 | 3.72 | 4.04 | 2.58 |

| Five Core Asset Portfolio | NA | 1.99 | 2.19 | 2.14 | 2.31 | NA | NA | 0.00 | 0.00 | 1.99 | 2.74 | 1.92 | 2.01 | 2.16 | 2.82 | 2.31 | 2.50 | 2.56 | 2.25 | 2.59 | 2.45 | 2.83 | 2.75 | 2.74 | 3.62 | 3.19 | 3.53 | 3.62 | 3.09 | 2.97 | 3.69 | 3.30 | 3.69 | 4.13 | 3.77 | 3.75 | 4.04 | 2.55 | |

| Three Core As…Portfolio | NA | 1.92 | 2.08 | 2.04 | 2.20 | NA | NA | 0.00 | 0.00 | 1.93 | 2.58 | 1.79 | 1.94 | 2.04 | 2.70 | 2.18 | 2.39 | 2.40 | 2.14 | 2.37 | 2.37 | 2.78 | 2.69 | 2.61 | 3.36 | 2.92 | 3.34 | 3.35 | 2.73 | 2.65 | 3.22 | 3.03 | 3.37 | 3.85 | 3.82 | 3.87 | 4.27 | 2.69 | |

| Two Core Asset Portfolio | NA | 1.86 | 1.89 | 1.84 | 2.01 | NA | NA | 0.00 | 0.00 | 1.87 | 2.29 | 1.57 | 1.65 | 1.91 | 2.45 | 2.05 | 2.17 | 2.22 | 2.01 | 2.15 | 2.25 | 2.59 | 2.56 | 2.72 | 3.11 | 2.83 | 3.16 | 3.21 | 2.65 | 2.59 | 2.82 | 2.67 | 3.12 | 3.84 | 3.93 | 3.80 | 4.57 | 3.93 | |

| Yale Endowment Template | NA | 3.77 | 4.11 | 4.40 | 3.89 | NA | NA | 3.66 | NA | 0.14 | 4.17 | 4.60 | 3.33 | 4.45 | 4.76 | 3.48 | 2.82 | 4.38 | 2.71 | 3.53 | 2.86 | 3.47 | 3.63 | 3.18 | 3.70 | 3.42 | 3.59 | 3.42 | 4.09 | 3.93 | 4.02 | 3.12 | 3.36 | ||||||

| S&P 500 Index | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

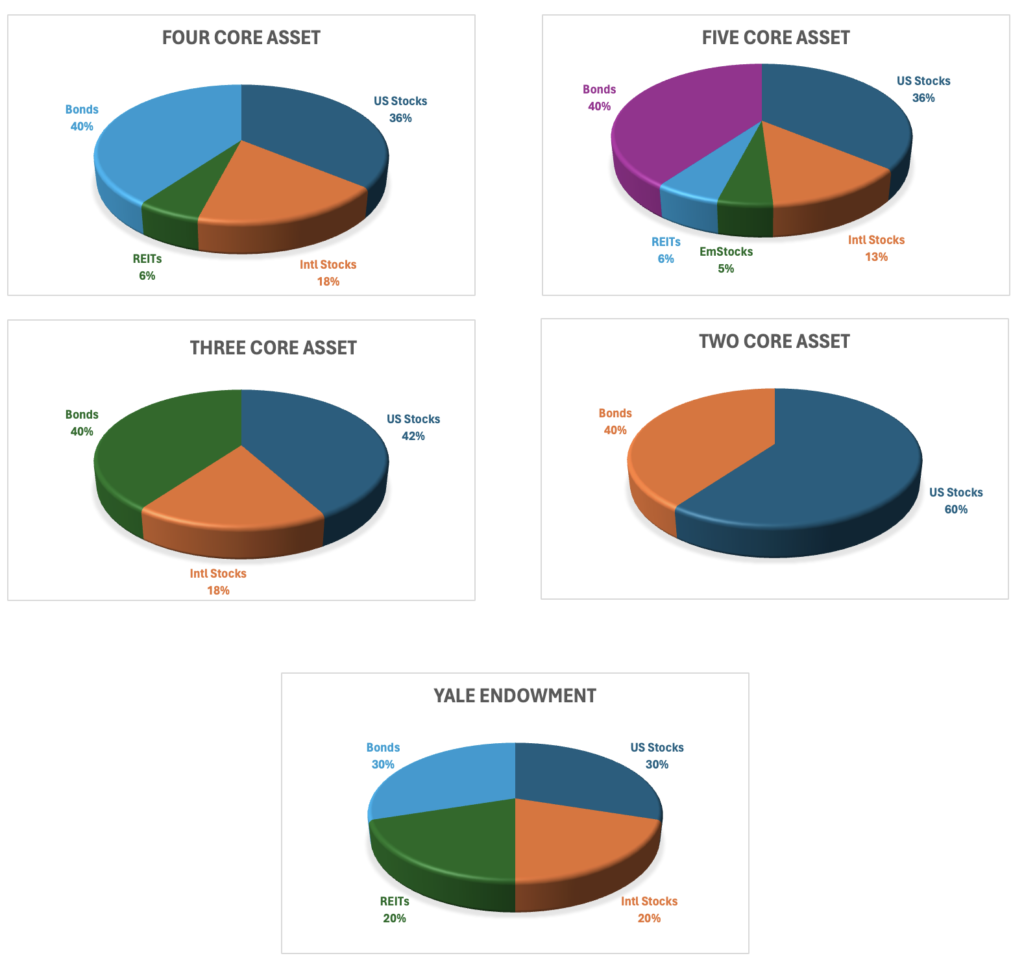

Here are the asset allocations for the templates:

Apart from the Yale Endowment template, which features a 70% risk allocation in stocks, the remaining four portfolios all maintain a 60% risk allocation. Investors ought to scale asset allocations proportionally according to the risk profile identified for the account. For instance, if your risk profile or risk allocation is 80%, and you opt to follow the Four Core Asset template, the scaling process would involve the following:

US Stocks: 48% (=36%*80/60)

Intl Stocks: 24%

REITs: 8%

Bonds: 20%

Refer to Bogleheads Lazy Portfolios or MyPlanIQ‘s Lazy Portfolios for more discussions and templates.