Category: Retirement planning

-

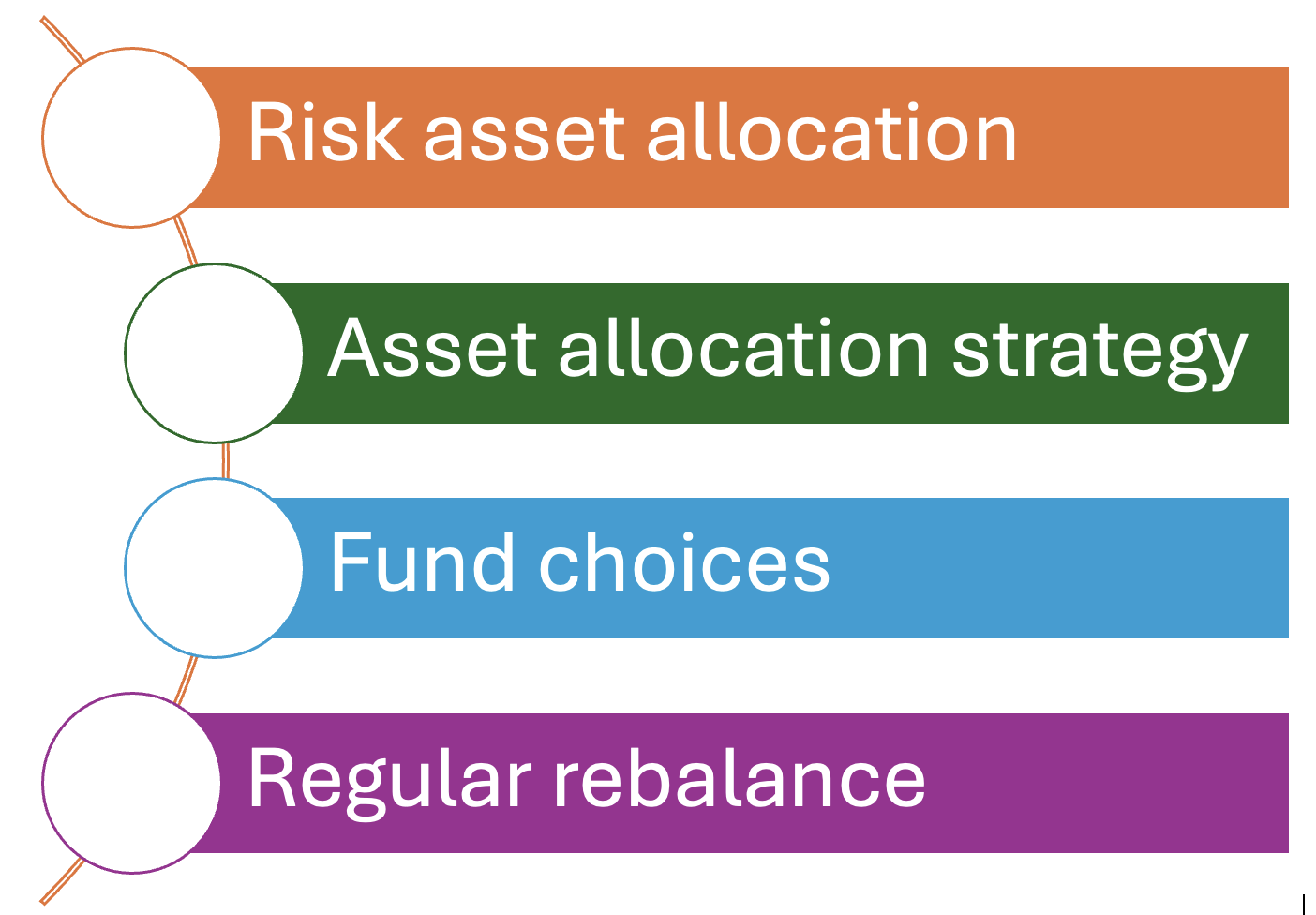

Four-Step Guide for 401(k) Retirement Investing

Navigating the complex world of 401(k) retirement investing can be daunting, especially when faced with many investment options. However, by following these four simple steps, you can strategically plan your investments and maximize your returns. Let’s delve into each step to ensure you make informed decisions for a secure financial future. Step 1: Decide your…

-

401(k) vs Indexed Universal Life Insurance (IUL): The Pros And Cons

401(k) is the most popular and simple retirement vehicle while indexed universal life insurance provides some assurance with the expense of complexity and cost.

-

Getting a 401(k) Loan: Why, How, and What to Watch Out For

We discuss several factors one should watch out when getting a 401(k) loan.

-

No Income Limit in Roth 401(k): A Compelling Tax-Free Retirement Investment

Roth 401(K) and Traditional 401(K) have no income limit and any one can contribute, unlike Roth IRA. However, there is an annual combined 401(k), Roth 401(k), 403(b) contribution limit.

-

401(k) vs Annuity: Beware of Fees And Income Stability

Fees and income stability are two factors to consider when choosing 401(k) and an annuity.

-

Deferred Compensation Plans vs. 401(k) Retirement Accounts: Understand the Key Differences

Deferred compensation plans are designed for highly compensated employees, executives, or key personnel within an organization. They are liabilities from employers.

-

Pros and Cons of Rollover from a 401(k) to a Self-Directed IRA

If you are an experienced investor or you are ready to be more disciplined, it’s in general better to rollover to an IRA when given a chance. However, if your existing 401(k) offers some features and funds that you don’t want to miss, you might want to make a careful decision.

-

What to Do with Your 401(k) When You Leave Your Current Employer?

We discuss four options for your current 401(k) account when you leave your job.

-

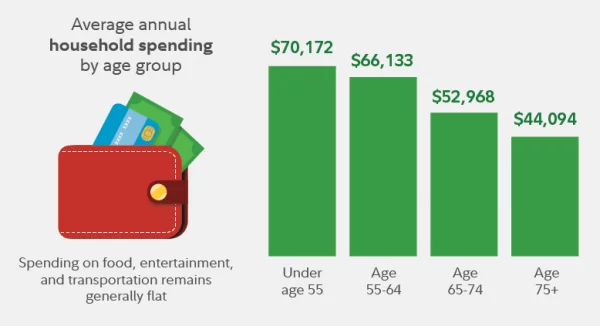

Retirement Income Replacement Ratio And Quality of Life in Retirement

retirement income replacement ratio is an important metric to consider when planning for retirement, but it is not the only factor that affects your quality of life in retirement. By understanding the relationship between retirement income replacement ratio and quality of life in retirement, and implementing strategies to improve both, you can enjoy a happy…

-

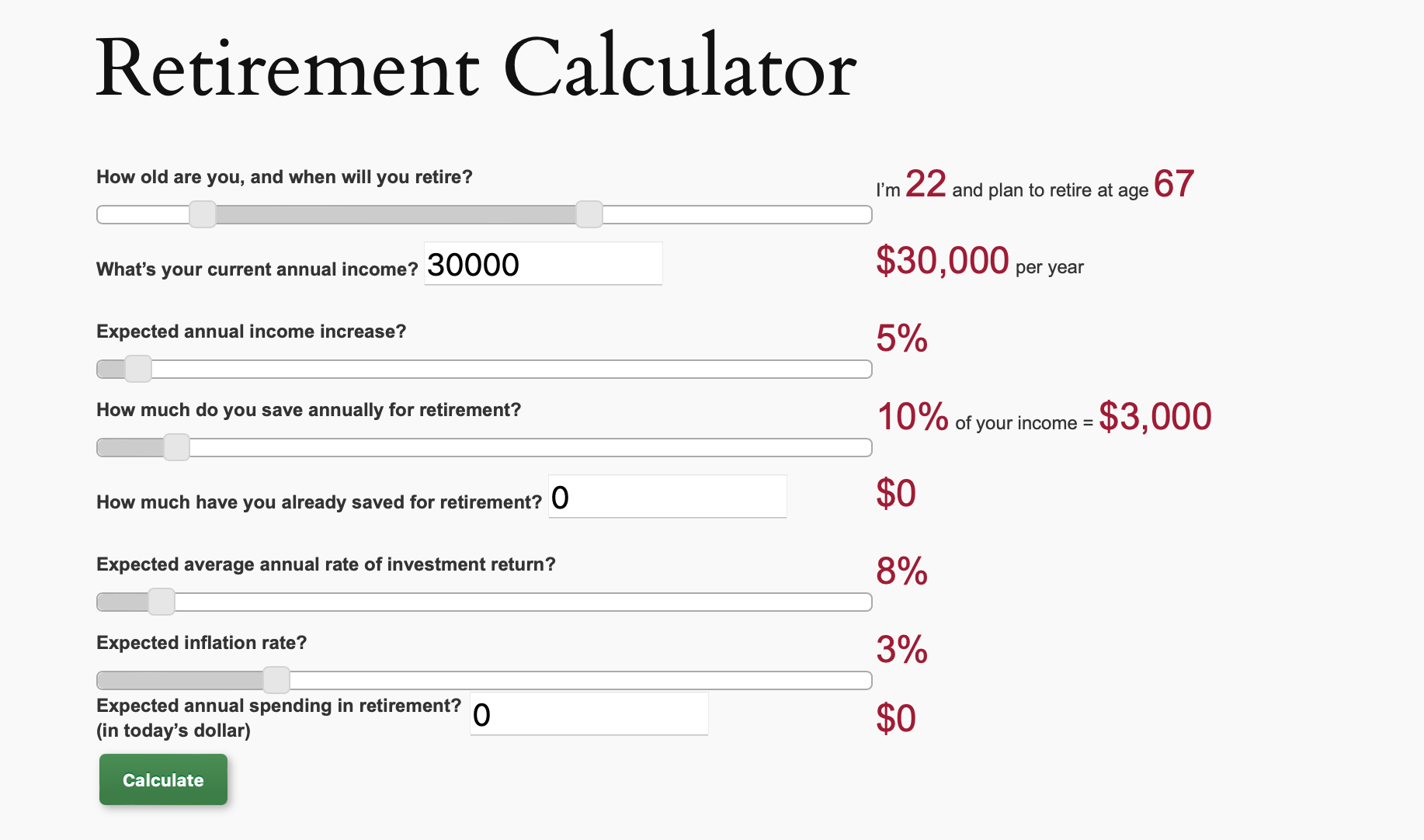

Save more, save early, and save smartly to retire as a multi-millionaire

Achieving substantial retirement income is possible through saving early, saving more, and saving wisely over an extended period.