Category: Retirement Plans

-

Four-Step Guide for 401(k) Retirement Investing

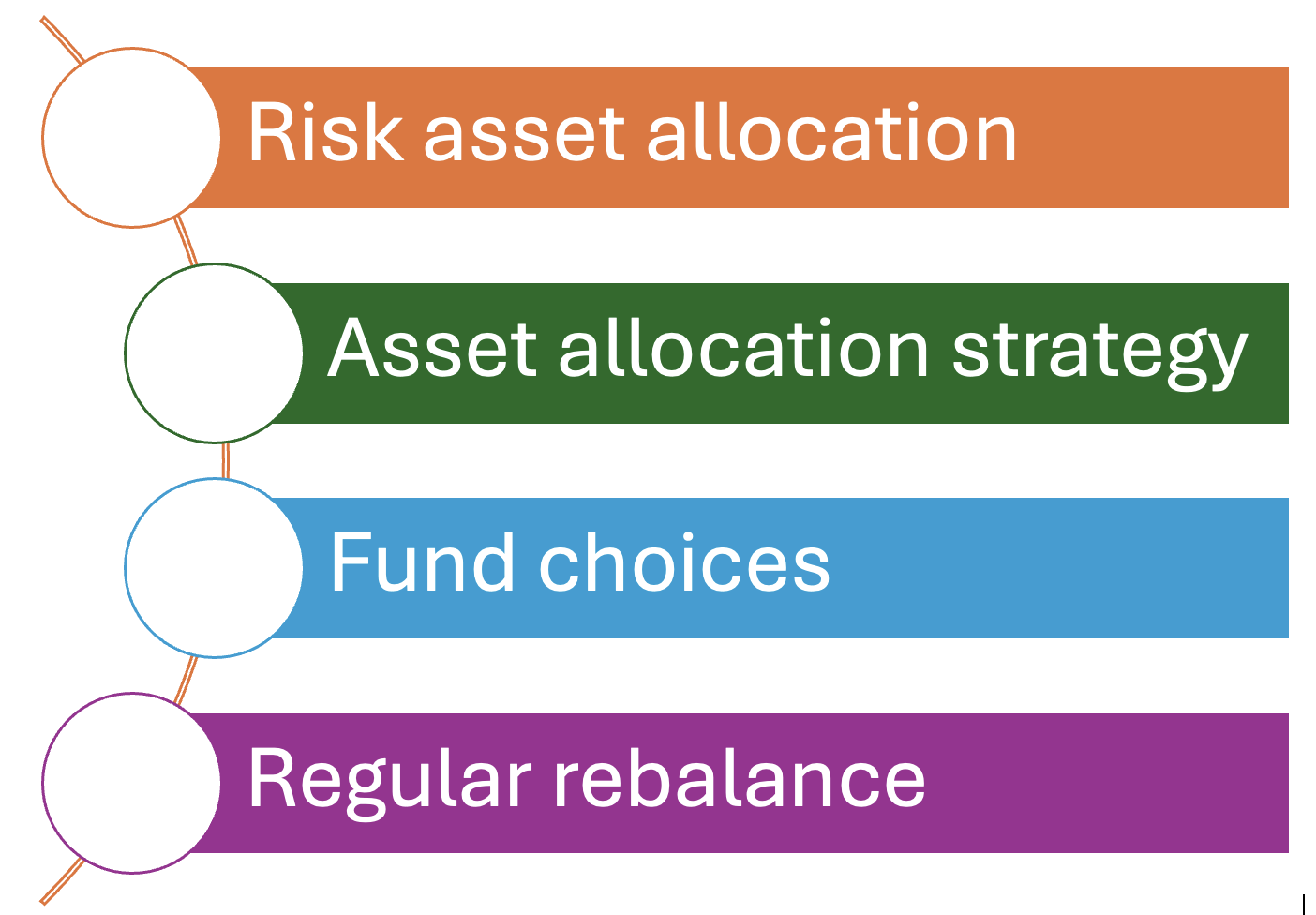

Navigating the complex world of 401(k) retirement investing can be daunting, especially when faced with many investment options. However, by following these four simple steps, you can strategically plan your investments and maximize your returns. Let’s delve into each step to ensure you make informed decisions for a secure financial future. Step 1: Decide your…

-

401(k) vs Indexed Universal Life Insurance (IUL): The Pros And Cons

401(k) is the most popular and simple retirement vehicle while indexed universal life insurance provides some assurance with the expense of complexity and cost.

-

Getting a 401(k) Loan: Why, How, and What to Watch Out For

We discuss several factors one should watch out when getting a 401(k) loan.

-

401(k) vs Annuity: Beware of Fees And Income Stability

Fees and income stability are two factors to consider when choosing 401(k) and an annuity.

-

What Happens If You Default on Your 401(k) Loan?

Default on a 401(k) loan has several consequences including your savings, tax, penalties etc.

-

Will Default on 401(k) Loan Impact Your Credit Score?

Yes, defaulting on a 401(k) loan does impact your credit score.

-

Use Your 401(k) Withdrawal or Loan to Buy a House?

Withdrawal or loan from a 401(k) could be considered an option only if there is a necessity or a unique investment opportunity.