Retirement is a time of life that many people look forward to, but it can also be a time of financial uncertainty. One important consideration when planning for retirement is your retirement income replacement ratio, which is the percentage of your pre-retirement income that will be replaced by your retirement income sources.

However, retirement income replacement ratio is not just a financial metric – it also has a significant impact on your quality of life in retirement. In this article, we will explore the relationship between retirement income replacement ratio and quality of life in retirement, and discuss strategies for improving both.

Retirement Income Replacement Ratio: Understanding the Basics

As we mentioned earlier, retirement income replacement ratio is the percentage of your pre-retirement income that will be replaced by your retirement income sources. A commonly cited rule of thumb is that retirees should aim for a retirement income replacement ratio of at least 70-80% of their pre-retirement income. However, this ratio may not be applicable to everyone, as everyone’s retirement income needs will be different based on their lifestyle, expenses, and other factors.

Intuitively, retirees have lower expenses in retirement because

- they no longer incur work-related expenses, such as commuting costs, work clothes, and lunch expenses

- many retirees may have paid off or reduced their mortgage or other debts.

- They may choose to downsize their homes or relocate to an area with a lower cost of living. For instance, retirees living in expensive places like San Francisco Bay Area or New York City often move to states like Florida or Texas. The reduction in cost of living can be substantial. Using a cost of living calculator like this, you can find out that living in Austin, TX is almost half the cost of living in San Francisco, CA, at a 46% cheaper rate!”

- in retirement, individuals are generally not required to pay Social Security taxes, Medicare taxes, or other payroll taxes, which can be a significant savings. Additionally, they may have other sources of income, such as Social Security benefits or retirement savings, that are taxed at a lower rate than their earned income.

- Social Security benefits and pension benefits

On the other hand, retirees may face higher expenses in certain areas such as healthcare costs or increased travel expenses. These expenses can offset the benefits of reduced living costs. Overall, many retirees experience lower expenses in retirement, while some may experience higher expenses due to various factors.

A recent study by Fidelity breaks down the average retirement income replacement ratio by income level and age group. For example, for individuals in the lowest income quintile (earning less than $50,000 per year), the replacement ratio is estimated to be 80%. This is much higher than the replacement ratio 55-65% for individuals earning more than $120,000, reflecting the fact that those with lower incomes have less discretionary income to cut back on in retirement. For high income earners like doctors and tech engineers, this ratio is probably at 55% or so.

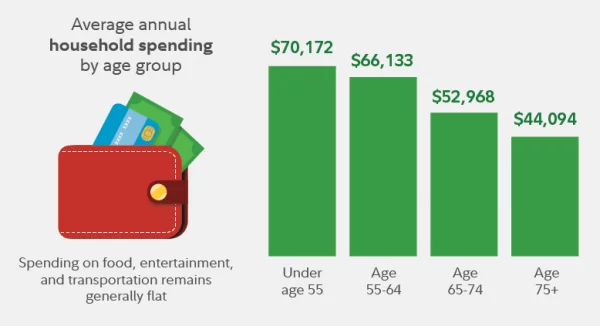

The study also found that the replacement ratio tends to decline as individuals age. For example, for individuals in the 65-69 age group, the replacement ratio is estimated to be 76%. This is lower than the replacement ratio for individuals in the 55-59 age group, which is estimated to be 83%. This decline in the replacement ratio as individuals age is due in part to reduced spending on travel and other leisure activities.

Quality of Life in Retirement

While retirement income replacement ratio is an important consideration when planning for retirement, it is not the only factor that affects your quality of life in retirement. Here are some strategies for improving your quality of life in retirement:

- Stay active: Staying active in retirement can help improve your physical and mental health, and give you a sense of purpose and fulfillment. Consider volunteering, taking up a new hobby, or joining a social group to stay engaged and active.

- Manage your expenses: Keeping your expenses in check is crucial to maintaining your financial security in retirement. Consider downsizing your home, reducing unnecessary expenses, and creating a budget to help manage your spending.

- Stay connected: Maintaining social connections in retirement is important for your emotional wellbeing. Stay in touch with friends and family, and consider joining a local community group or social club to stay connected with others.

- Invest in your health: Investing in your health is crucial to enjoying a high quality of life in retirement. Consider getting regular checkups, eating a healthy diet, and staying active to maintain your physical and mental health.

In conclusion, retirement income replacement ratio is an important metric to consider when planning for retirement, but it is not the only factor that affects your quality of life in retirement. By understanding the relationship between retirement income replacement ratio and quality of life in retirement, and implementing strategies to improve both, you can enjoy a happy and fulfilling retirement.